ONE’s Prudent Investment Offering Takes Shape

ONE’s emerging investment offering

ONE Investment has been creating a new offering for municipalities who want to move towards Prudent Investing. Led by our internal consultant, with the support of our expert Investment Advisory Committee, we are working through the strategic decisions to have a Prudent Investor offering available later this year.

Of course, we will continue to support municipalities investing under the Legal List regulations. In fact, the capability we are building for prudent investors will also enhance our services for Legal List investors.

ONE’s Investment Philosophy

Our investment solutions are being designed to fit municipal needs as closely as possible. We recognize that municipalities are operating entities with constantly shifting priorities. From an investment perspective, municipalities are quite different from, say, pension funds that tend to have a stable amount of money to invest and consistently steady payouts to make from those funds. We realize that municipal timeframes shift with some frequency, as do the amounts needed—and we need to take that into account when designing solutions for you.

ONE Investment wants to be your investment department!

We expect to help municipalities that are considering prudent investing to identify investable funds, educate staff and Council on their risk tolerance, and decide how to invest that money. To accommodate your changing needs, flexibility on our part is key. And it will be crucial to have regular communications between the municipality and ONE’s internal investment manager. We look forward to working with municipalities to ensure those lines of communication are open so that your investments are optimized to meet your needs.

Outcome Investing

Based on input from several municipalities and municipal finance experts, we have identified three fundamental investment needs for your long-term funds, with corresponding investment solutions. These will have asset mixes formed from a series of building block funds. The building blocks will be managed by external investment managers and will also include the current ONE Investment portfolios. The weights of the building block funds within municipal portfolios will be managed by an internal investment manager who also acts as your investment advisor. Following are the outcomes we are building:

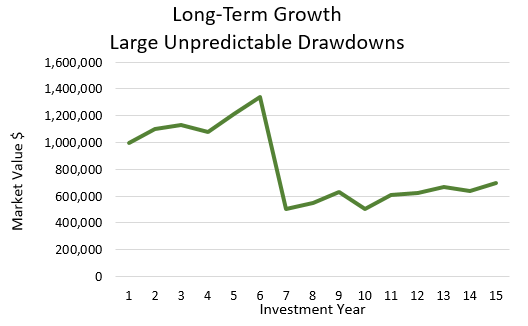

1. Contingencies

These are long-term savings that are drawn on for emergency needs, which might include things like natural disasters. They are intended for situations where municipalities are uncertain as to the timing of the need and probably also the amount. We are proposing to invest these funds for low-risk, long-term growth with a view to gradually building them up. Funds will be drawn down somewhat when needed and amounts remaining in the fund will continue to be invested for long-term growth to build back up for future contingencies. The following graph shows how the investments in a contingency account might grow over time.

|

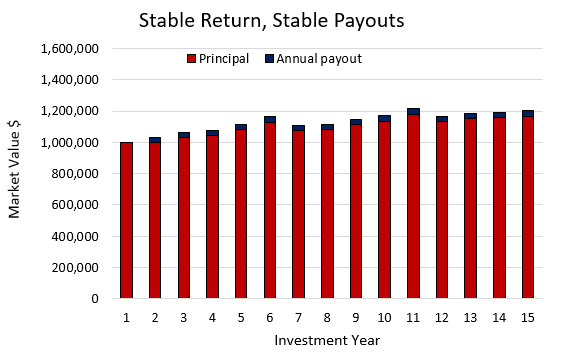

2. Stable returns

These funds are invested with a view to preserving principal to deliver stable long-term returns that support regular infrastructure needs. For example, an endowment for a heritage building may fund the property; or an arena may need ongoing maintenance funded from a pool of capital. This money is intended to generate a steady, reliable return from a combination of income and capital gains and will be invested in lower risk, stable return investments that aim to preserve capital. The following graph shows how the principal is intended to grow moderately while paying out a stable return.

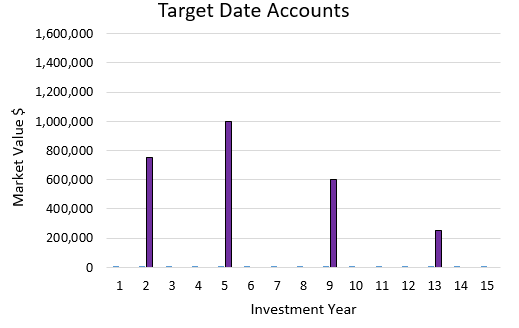

3. Target date projects

When municipalities are fairly sure of the amount of money they will need for a project and the timing of the project, they may invest in a target date solution. For example, an amount is set aside to fund a new bridge in 2027 or to replace a road in thirty years. The target date solution allows you to save towards that objective and the investments will be managed to reduce risk as the target date approaches. We aim to match the timeframe of the project to the investment to reduce the risk of not having funds when you need them. This allows investors to take more risk for longer term objectives and reduce the likelihood of losing money shortly before you need to draw on it. The following chart shows how you might set up target date accounts.