Why should your municipality be investing beyond your bank account?

Municipalities face a range of financial challenges. Growing service demands and expanding capital asset management needs require more spending, but there are few new revenue sources. Municipal governments must find a way to make current resources go further.

One of these resources is cash – the inflow of which rarely matches the timing of municipal expenditure obligations. For example, property tax revenues generally are collected in installments, while municipal payroll obligations, transfers of education taxes, upper tier levies (where applicable), and other similar spending commitments occur at numerous points throughout the fiscal year. Municipalities also need to invest reserves, sinking or retirement funds, and proceeds of debenture issues until the funds are needed.

Some municipalities deal with this challenge by hiring professional investment management staff. Others choose outside portfolio management and/or investment counselling service providers, but many choose simply to park money in a bank account or a GIC. For municipalities with some understanding of their short- and longer- term cash needs, participating in a professionally managed investment portfolio is an opportunity to earn market competitive returns while ensuring the safety and liquidity of the funds.

The Municipal Act

Section 418 of the Municipal Act and the Eligible Investments Regulation (O. Reg. 438/97) offer a prescriptive set of municipal investment opportunities, and related restrictions. These rules require municipal oversight and accountability.

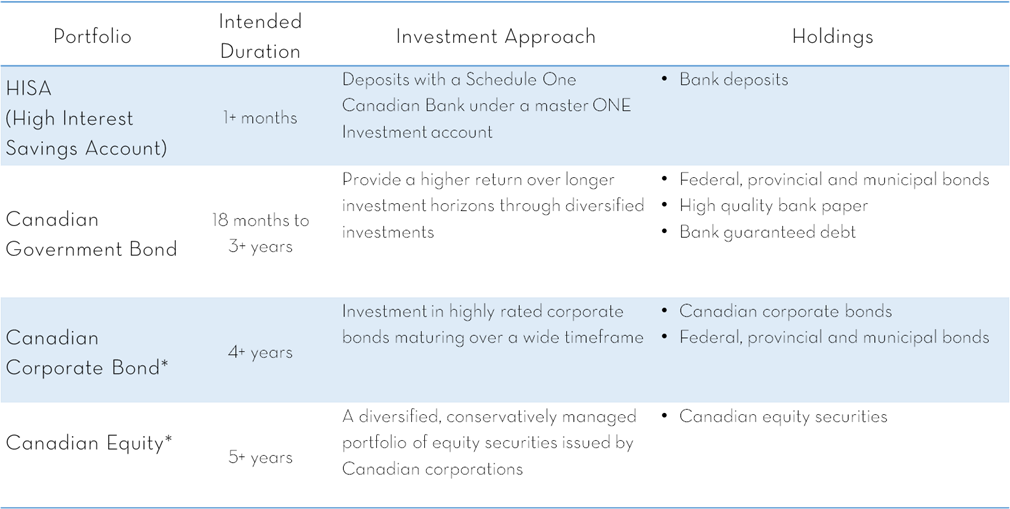

ONE Investment offers four investment opportunities under the Municipal Act’s Legal List of investments that are guaranteed to be fully compliant with the Act. In fact, ONE Investment (and LAS/CHUMS) are specifically named in the Eligible Investments Regulation.

ONE’s co-mingled investment offerings provide confidence in terms of compliance, while allowing municipalities to develop and implement an investment policy that considers risk, capital preservation and diversification.

ONE Investment was designed by municipal and investment professionals more than 30 years ago to provide needed services to the sector. The products that have since been developed help to reduce municipal investment risk and to ensure appropriate diversification.

It is important to note that ONE Investment’s team is available to provide investment insights to any Ontario municipalities whether or not they participate in ONE Investment. ONE is a not-for-profit focused on delivering the best outcomes for municipalities, even if a non-ONE product is recommended.

Fact: By diversifying investments among a variety of financial instruments from different issuers, and economic sectors, ONE’s portfolios help protect municipalities, mitigating the risk associated with adverse changes in credit, interest rate and market conditions.

What are the advantages of taking part in ONE Investment?

Legality: ONE Investment guarantees full compliance with the Municipal Act and Eligible Investments Regulation (O. Reg. 438/97).

Safety and liquidity: Municipalities that use co-mingled investments like ONE Investment portfolios, face lower default risk, market risk, and liquidity risk. ONE’s portfolios are well diversified, managed by professionals and provide liquidity when needed. They offer the opportunity to earn a highly competitive rate of return, regardless of the amount of invested.

Cost effective: Certain types of investments can only be accessed in large volumes and/or at high transaction costs. Co-mingled investments like ONE Investment allow municipalities to participate at institutional market prices by combining their investment resources and minimizing costs for all participants.

Access to otherwise unavailable Instruments: Longer term Canadian corporate bonds (greater than 5 years) and Canadian equities are not available to individual municipalities except through ONE Investment as per the Eligible Investments Regulation.

Expertise: Most municipalities do not have the resources to be active portfolio managers or hire staff with the requisite expertise to oversee and administer an investment portfolio. Participation in an investment offering like ONE Investment provides access to professional expertise with proven track records, oversight and compliance.

Oversight: ONE Investment’s Legal List portfolios are governed by the ONE Investment Board with additional oversight and advice provide by an Investment Advisory Committee, comprised of investment sector experts and a legal representative.

Stepping stone: Co-mingled investments, like ONE’s Legal List portfolios, are a great way to gain comfort investing public monies, as a first step to becoming a Prudent Investor (under Section 418.1 of the Act). Our Q4 newsletter article will discuss this further.

ONE’s Legal List Options:

Next Steps

Reach out to ONE Investment staff to discuss your investment options, the Municipal Act rules, your investment policy and to learn more about ONE Investment.